· 6 min read

You Must Pay Workers

Learn the basics of employment law. Employers must pay all workers a minimum wage in cash and must pay employer taxes. This is not only the law, it is respectful.

Founders start companies because they are excited about their products. Maybe some of their friends are too. So they start a company and start working on the idea.

Maybe they don’t have any money, and they figure they are building equity in the company by creating a valuable company, so the idea of paying a salary and paying employer taxes doesn’t apply to them. After all, they are the good guys, right? Let’s talk about that.

The Minimum Wage The U.S. has a long, despicable history of not paying workers. From slavery to sweatshops and the depression, business owners have for most of U.S. history thought they could abuse workers. After the great depression in the 1930s, workers had finally had enough. The Fair Labor Standards Act (FLSA) was passed to give every worker a minimum wage. There are exceptions, which you can read about here. However, the basic idea is that if you are working at any job, you should be paid a minimum cash salary. Don’t focus on the exceptions, focus on that.

How Much? The Federal Minimum Wage is $7.25 per hour. If you cannot afford to pay that, you should not be employing workers. That is very little. Most cities and states have laws requiring a higher rate of pay. Employers must comply with all labor laws they are subject to, wherever the employee lives. So, for instance, if an employee lives in Portland, Oregon, they would have to comply with city, county, state, and Federal laws. The intention of the law is that employees should make a living wage. In practice, the minimum wage doesn’t come close to that, but it is a start.

What About Volunteers? There is no such concept as a volunteer for a for-profit entity. Volunteering for a company is illegal. The law says that workers shall be paid a minimum wage if the employer suffers or permits them to work for the company. This means that if you need help at a trade show, and you ask your daughter and her boyfriend to help you man the booth, you need to pay them. It is not cool to not pay workers.

But they are getting Equity! The law wants to make sure employees get a minimum amount of cash compensation. Equity does not count towards the minimum wage.

Paying Yourself and Your Partner There are numerous exceptions to the law, and I could not possibly go through them all. But if you have just started a business, and you have less than $500,000 in revenue, you are just selling in your own state, and it is only you and your partner, the Federal law probably exempts you from paying wages. You can read about that in the first link I posted. However, your city or state may require you to pay wages to yourself and your partner even in this case. So to be on the safe side, and to be respectful, always pay at least the minimum wage required by your city, state, and the Federal government.

What about overtime? If employees work more than 40 hours per week, the excess is considered overtime and must be compensated at 150% of the normal rate. If you would like to avoid paying overtime, that is a possibility. For certain types of higher-level workers, you can pay them a minimum salary increasing to $58,656 per year on January 1, 2025, and they will become exempt from overtime wages. You may have heard the term Exempt Employee. That’s what that means.

Again, it is instructive to understand the spirit of the law. The subtitle of the linked article says Rule ensures salaried workers making less than $58,656 receive fair pay for long hours.

Employer Taxes But wait, there’s more. You can’t just pay the worker the minimum wage out of your pocket in cash and be done with it. You have to pay employer taxes, and you have to deduct some taxes that the employee is obligated to pay. In practice, this means that you need to get help from a payroll provider. Popular choices are ADP RUN, Gusto, or QuickBooks Payroll. Anderson CFO is a Certified ProAdvisor for QuickBooks Payroll.

But if they earn less than $600, can I pay them cash and avoid employer taxes? No, you still have to pay employer taxes and set them up as employees in your payroll system. That $600 limit applies to contractors, which we aren’t going to treat here.

Worker’s Compensation Insurance All states require that workers are covered by Worker’s Compensation Insurance. Most Payroll providers will help you purchase this insurance. The rates are set by the states. However, each insurance company may set a minimum premium amount, so you should be vigilant as you shop around. Please also be aware that the insurance premium depends strongly on the type of work the employee does. An office worker’s insurance rate is much lower than a farm worker’s rate, because of the risk of injury. Make sure the insurance company classifies your employees correctly. I once had an insurance company charge over ten times what we should have paid by intentionally misclassifying workers.

Please also know that not all workers must be covered by worker’s compensation. If your company is very small, you may be able to avoid getting a policy entirely. Check with your state.

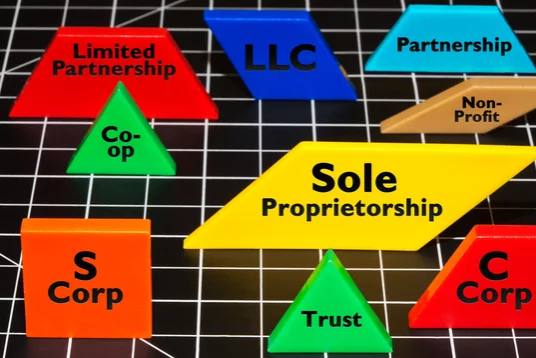

Reasonable and Customary Compensation The government doesn’t want corporations to accumulate profits and avoid paying employment taxes by just paying minimum wage. So there is an additional requirement that S-Corps and C-Corps must pay a reasonable and customary market wage for work performed, if they can afford it. The purpose of this is to avoid profits piling up in the company bank accounts and the owners never paying employment taxes on it. This is not meant to apply to very small companies that can’t afford to pay an IT worker $200,000.

Human Resources Think of yourself as an advocate for your employees. Employees work at their best when they are being paid what they feel they are worth. If you underpay your employees, they will not give you their best. You may also consider other benefit programs such as medical insurance, long-term disability insurance, and a 401K retirement plan.

The goal of this piece has just been to point you in the right direction. It is not supposed to be an exhaustive list of everything you need to know. Feel free to reach out if you’d like some help.