· 5 min read

Legal and Finance Basics

Discover the essential legal steps for starting a business, from choosing a name and incorporating to managing share registers and complying with investor regulations.

One of the most frequent topics that comes up among founders is the basic legal structures and rules that all companies must follow. Unless you are a lawyer, it isn’t a fun topic. But it is one that everyone has to deal with. So much has been written on this topic, but I feel that I can add by dealing with all the basics at once.

Choosing a Name. The first thing you will need to do is to check to see that the name you want to do business as is not taken. You can do this at the Secretary of State’s website. You might also want to make sure that the website you want is available. If you plan on trademarking your name, you will want to choose a name that is fanciful and imaginative. That’s the Patent & Trademark office’s advice, not mine. So Kazingy would be a great name, but Minty Chocolate Cookies would not. Go onto Youtube and make sure the name is not being used by any videos. Believe it or not, the Patent and Trademark office does this.

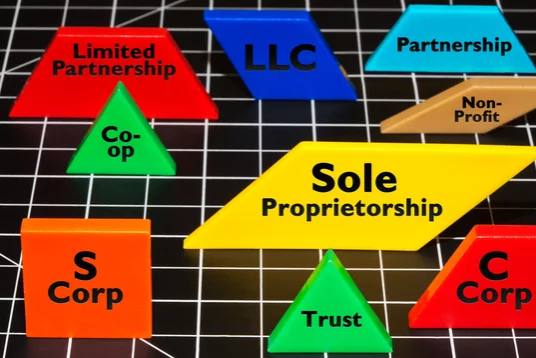

Incorporate as a C-Corp. As opposed to an LLC, a partnership, or an S-Corp, if you want to raise money from venture capitalists, they will insist on a C-Corp. This is because only C-Corps go public, and most venture capitalists want companies that will go public. Also, only C-Corps can have multiple classes of stock, and venture capitalists will insist on preferred stock. For this reason, the most prominent online legal service Clerky only allows C-Corp incorporation, and only in Delaware.

Registration in Multiple States. If you do business in multiple states, including having employees in those states, you will have to register in those states. You’ll only be incorporated in one state, but you will have to register with the Secretary of State in other states if you have employees or do enough business to have to pay taxes in those states.

Registered Agent. In every state you are registered in, you need someone in that state who can accept legal documents. That person or company has to have a street address, not a PO Box. This is called a Registered Agent. You can pay a company to do this for you. I recommend Cogency Global.

Articles of Incorporation. The most basic legal document is the Articles of Incorporation. This is the basic agreement between you and the State about what you are doing and what you are allowed to do. Specifically, it says how many shares of stock you are allowed to sell. Every time you sell stock, you need to make sure that this document is updated to allow the stock. If you don’t do this, you are selling nothing, which is fraud.

83(b) election. If you have issued yourself or anyone stock options or stock that vests, then Within 30 days of the formation of your company, you must mail your 83(b) election to the IRS. There is no way to fix this if you don’t do it. When you eventually hire lawyers, they will be very upset if you haven’t done this, so do it.

Use Clerky. Most companies will not have the money to pay a securities lawyer to do their legal work at the beginning. Fortunately, Clerky can do a lot of this work for you. They are a company founded by two Silicon Valley lawyers. They have developed standardized documents to take care of all of this. I recommend reading through their Introduction · Legal Concepts for Founders. Here is a very thoughtful independent review.

SEC Form D. Whenever you do a stock issuance, you need to give notice to the SEC that you are doing this through a Form D. It does not appear that Clerky does this for you.

Accredited investors. You are not allowed to sell stock to people who are not accredited investors. This generally means that they have a liquid net worth of over $1 million or an income over $200,000 per year. The reasoning is that accredited investors can bear a loss better than most. I recommend requiring investors to prove they are accredited by using the free service at Parallel Markets. Yes, you can get around this by doing crowdfunding, but I don’t recommend it.

SAFE Another of the most frequent questions is what form of equity should be issued, a SAFE or a priced round. The SAFE is a relatively new creation, but it has become so popular that now it is the only form of equity that Clerky supports. When you are ready for Venture Capital, you will need to hire a lawyer and do a Series A. Everything before that point is a SAFE. There are a lot of good articles on this topic. Here is one from Latitud, another from Carta, as well as a cautionary article about SAFES from PNW Startup Lawyer. Although PNW Startup Lawyer may be correct, SAFES have become so popular that you may not have a choice.

Share register. You will need to keep track of who you have issued shares to. There are a lot of companies who offer this service. The market leader is Carta. Don’t use them. They are expensive and demand that all changes be made by a lawyer. Instead, use Global Shares. It is free for fewer than 100 shareholders and does not require a lawyer. They are owned by J.P. Morgan.

I hope this has been helpful for you. Getting a securities lawyer to do this work for you can cost between $5,000 and $20,000 per month. So if you feel comfortable doing it yourself, or letting Clerky do some of it, you can save money.

The goal of this piece has just been to point you in the right direction. It is not supposed to be an exhaustive list of everything you need to know. Feel free to reach out if you’d like some help.