· 5 min read

Forecasting Your Business

Learn how FP&A tools like Causal help businesses predict outcomes and manage uncertainty, essential for management and impressing investors.

The only thing that is certain is death and taxes. For corporations, there is even less certainty. Yet companies cannot operate without an idea of what may occur and the consequences. There is a range of plausible outcomes, and these must be prepared for. But how?

This is an important area for any business. It is known as Financial Planning and Analysis, or F P & A. If you do a search on any job board, you will see F P & A is in demand. F P & A requires technical skill and common sense. As a Fractional CFO, F P & A is part of our core offerings. We collaborate with the client, listening to their concerns and goals, and give the business owner comfort about what might happen.

Clients often want to answer questions such as:

How much cash will I need to launch a new product?

What if the product launch is delayed?

What happens if sales are half of what I expect? Or twice?

What happens if our cost of goods declines from 50% to 40% of the wholesale price?

What happens if we sign up with a co-packer with higher minimum production runs but lower tolling costs?

How much cash will I need before I become profitable?

What is the potential cash need of the company if our sales team closes on average 50% of their pipeline?

How much longer would our cash last if we fired a couple of people?

Not only are the answers to these questions useful for company management, but investors also want to see that you have thought about them. Investors are used to seeing analysis like this from larger companies. It is impressive if a small business is able to show the same level of sophistication.

In the past, there were only very few, expensive systems capable of answering these questions. Hyperion Planning was one such well-known system, but it was out of reach of small and midsize companies. Now, there is a range of options, including some for small businesses. We use Causal, which is quite affordable and powerful.

Why not just use a spreadsheet? There are principally three reasons:

Connection to company data. Forecasts need to use the latest data from the company accounting system and potentially other important data sources. F P & A systems have proprietary connectors to popular accounting, Human Resources, CRM, databases, and even spreadsheets. The data is seamlessly brought into the F P & A tool and forecasts are updated.

Ability to add uncertainty. F P & A tools critically allow you to provide a range of values for any variable. For instance, you could tell the program that your broker may succeed in getting you into between 1000 and 1500 stores each year for each product. Or that velocity at Costco might be between $1,000 and $1,500 per store per week. Or that your new product will sell between 70% and 150% as fast as your current product. To be honest, spreadsheets have this capability, too through add-ins, or even in a basic form through Excel’s scenario analysis tools. But because they lack the other capabilities in this list, spreadsheets are not as effective as dedicated F P & A tools.

Ability to deal with multiple items as one. This is the killer feature. The problem with spreadsheets is that they become unwieldy because formulae have to be copied over and over and errors are next to impossible to track down. F P & A systems like Causal allow you to construct a model of the business with only a few lines.

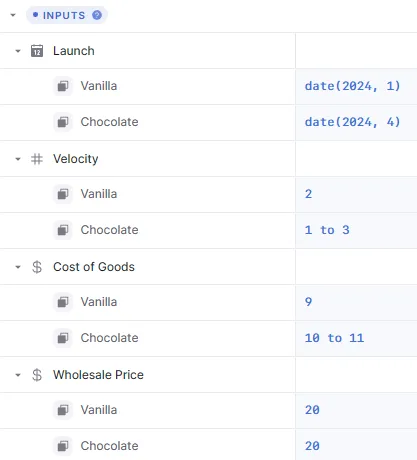

Let’s give an example. Suppose we are running an ice cream company. We launched vanilla in January, and it is going well. It is selling 2 cases per store per month. We’re selling it for $20 per case, and it costs us $9 to make. Our broker is succeeding at getting us into between 500 and 1000 stores every year after the launch date of a product. We are so excited that we are going to launch chocolate in April. But we’re not sure how much it will sell. We think maybe between 1 and 3 cases per store per month. Also, we’re not sure about the price of chocolate, since it is fluctuating. So unfortunately, chocolate could cost between $10 and $11 to make. I’d like to see a chart of the profit for the next two years.

The inputs look like this

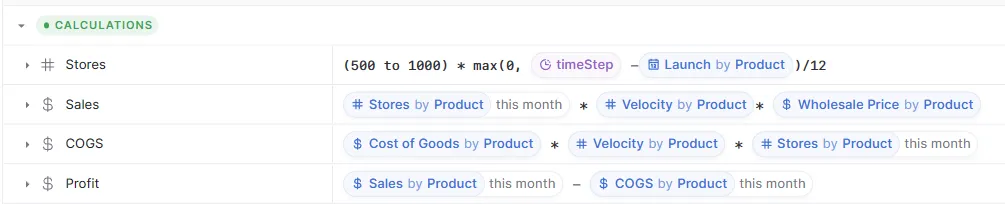

The entire model is then four lines:

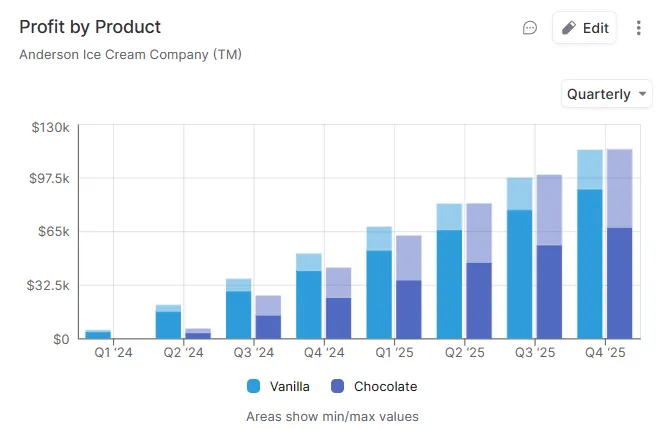

Here is a chart of the profit by product over the next few quarters. Although chocolate starts off slow, there is a chance that it will catch up to vanilla next year, despite the higher cost of chocolate, if the sales are at the high end of the range.

The light shaded areas represent the range of possible outcomes. Because the price of chocolate is uncertain, the number of stores we will get into is uncertain, and the velocity of chocolate is uncertain, there is a range of possible outcomes.

It would be very difficult to do this in a spreadsheet, and certainly not in four lines. Causal allows us to treat all products with the same formula and to write intuitive formulae extremely quickly.

We could go further and ask about how much cash we would need if we want to keep three months of inventory on hand, or if we are able to get better payment terms from our vendors. Anything is possible. The goal is to accurately model the business and get insight into what could possibly happen.

Cash flow forecasting and F P & A are two core services we offer to customers. If you are interested in having insight into what the future could hold for your company, please contact us.