· 3 min read

The Purpose of Accounting

Understand the crucial role of accounting in securing investments and maintaining financial health for CPG businesses. Learn how to manage costs, chargebacks, and ERP systems for better financial transparency.

In an ideal scenario for many entrepreneurs, accounting would be a non-essential aspect of business operations. Their focus would primarily be on product development, sales, marketing, and the anticipation of a positive financial trajectory. However, the reality of establishing a successful enterprise demands a rigorous and disciplined approach.

Last week, we highlighted the importance of identifying products that yield a minimum of 40% gross margin post-trade expenditures. Convincing potential investors of this is crucial for securing the investment required for business growth. This article delves into the indispensable role of accounting in providing investors—and the entrepreneurs themselves—with the necessary assurance regarding the financial health and profitability of their ventures.

Accounting provides investors with a transparent and accurate depiction of a company’s financial stability and profitability. It adheres to regulations designed to ensure that financial statements accurately reflect the company’s economic activities and performance.

In the Consumer Packaged Goods (CPG) sector, accounting complexities can arise due to the nature of sales and distribution channels. Consider a scenario where a product is sold through distributors to retail outlets, with a promotional campaign scheduled for April. The procurement of raw materials and production might occur in January and February, with the product being sold to distributors in March. Subsequent months may see chargebacks from distributors and retailers related to the April promotion, complicating the financial picture.

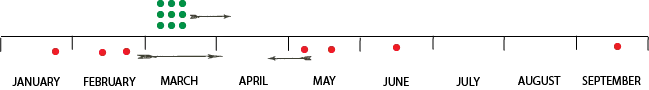

In the graphic below, each dot represents $1,000. So you bought $3,000 of product/ingredients in January and February, invoiced the distributor $9,000 in March, and then received $4,000 of chargebacks from May to September.

To accurately present financials to investors, it would be misleading to report losses in January and February, a profit spike in March, followed by losses in subsequent months due to chargebacks. A more coherent approach involves consolidating all related costs into the month of April, recognizing $9,000 of revenue, $3,000 Cost of Goods Sold (COGS), and trade spend of $4,000, resulting in a gross profit of $2,000. This method aligns with accounting standards and provides a clear, logical view of the business’s financial performance.

On the purchasing and production side, you need systems that keep track of the cost of ingredients. These so-called Enterprise Resource Planning (or ERP) systems require extensive expertise to implement. Some are rather expensive. Others are perfectly adequate and more affordable.

You also need a way to track all the distributor and retailer chargebacks and assign them to the respective promotional campaigns. Historically, distributor chargebacks were only available in paper form. You might get hundreds or even thousands of pages mailed to you. To disentangle this, a team of full-time people was needed to verify/dispute the deductions and assign them to the correct time periods, customers, and promotions.

Nowadays, there are automated software solutions (such as Glimpse, TrewUp or Vividly) that streamline the management of chargebacks and provide insights into customer relationship profitability. These tools are instrumental in identifying and expanding profitable relationships while discontinuing unprofitable ones, thereby improving business profitability and health.

The establishment of robust business systems for tracking production costs and accurately assigning chargebacks is vital for understanding a company’s profitability. This understanding is a prerequisite for attracting venture capital investment. However, many small businesses lack the resources and expertise to navigate these challenges effectively, underscoring the importance of professional guidance.

For businesses seeking to position themselves for success, engaging with experts to develop and implement the necessary accounting and operational systems is a critical step.